Roberts: The US Is a Bankrupt Superpower

Crisis Is Beyond The Reach of Traditional Solutions

By Paul Craig Roberts / November 13, 2008

By most accounts the US economy is in serious trouble. Robert Reich, an adviser to President-elect Obama, calls it a “mini-depression,” and that designation might be optimistic. The Russian economist, Mikhail Khazin says that the “U.S. will soon face a second ‘Great Depression.’” It is possible that even Khazin is optimistic.

I cannot predict the future. However, I can explain what the problems are, how they differ from past times of troubles, and why traditional remedies, such as the public works programs that Reich proposes, are unlikely to succeed in reviving the U.S. economy.

Khazin points out, as have others such as University of Maryland economist Herman Daly and myself, that consumer debt expansion is the fuel that kept the U.S. economy alive. The growth of debt has outstripped the growth of income to such an extent that an increase in consumer credit and bank lending is not possible. Consumers are overburdened with debt. This fact takes monetary policy out of the picture. Americans can no longer afford to borrow more in order to consume more.

This leaves economists with fiscal policy, which, as Reich realizes, also has problems. Reich is correct that neither a reduction in marginal tax rates nor a tax rebate is likely to be very effective. Reich, a Keynesian, has an uncertain grasp of supply-side economics, but as one who has a firm grasp, I can attest that marginal tax rates today are not the stifling influence they were prior to John F. Kennedy and Ronald Reagan. As Art Laffer said, there are two tax rates, high and low, that will produce the same tax revenues by expanding or contracting economic activity. Marginal tax rates are no longer in the higher ranges. As for a tax rebate, Reich is correct that in the present situation a tax rebate would be dissipated in paying off creditors.

Reich sees the problem as a lack of aggregate demand sufficient to maintain full employment. His solution is for the government to spend “a lot” more on infrastructure projects on top of a trillion dollar budget deficit --”repairing roads and bridges, levees and ports; investing in light rail, electrical grids, new sources of energy.” This spending would boost employment, wages, and aggregate demand.

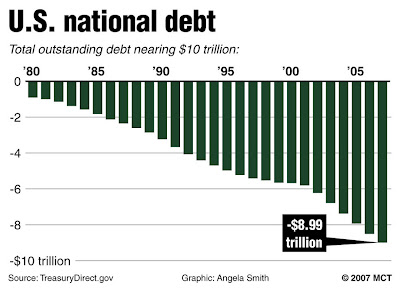

I have no opposition to infrastructure projects, but who will finance the baseline trillion dollar US budget deficit plus the additional red ink spending on infrastructure? Not Americans. The US savings rate is zero or negative. Home mortgage foreclosures are in the millions. Officially, US unemployment is 10 million, but if measured by pre-Clinton era standards unemployment is much higher. Statistician John Williams, who measures the unemployment rate by the pre-Clinton standards concludes that the rate of US unemployment is about 15 percent. President Clinton “reformed” the unemployment statistics by ceasing to count discouraged workers as unemployed.

For years, the US government’s budget has been dependent on foreigners financing the red ink. Countries such as Japan and China and OPEC suppliers of oil to the US have huge export surpluses with the US. They recycle the dollars by buying US Treasury bonds, thus financing the US government’s red ink budgets.

The open question is: how much longer will they do so?

Foreign portfolios are overweighed in dollar assets. Currently the dollar’s value is benefitting from the financial crisis, as investors flee to the reserve currency. However, sooner or later the huge outpourings of dollar debts will cause foreign creditors to draw back. Already China, America’s largest creditor, has sent a signal that that time might be drawing near. Recently the Chinese government asked, as they do indirectly through third parties, “Why should China help the US to issue debt without end in the belief that the national credit of the US can expand without limit?”

Is the rest of the world, which has demanded a financial summit to work toward a new financial order, going to permanently allocate the world’s supply of capital to covering American mistakes?

If not, the bailout and the stimulus package will have to be financed by printing money.

And the bailout needs are growing. Car loans and credit card debt were also securitized and sold. As the economy worsens, credit card and car loan defaults are rising. Moreover, AIG needs more money from the government. Fannie Mae’s loss has widened to $29 billion despite the $200 billion bailout. General Motors and Ford need taxpayer money to survive. General Motors says that its GMAÇ mortgage unit “may not survive.” Deutsche Bank sees General Motors shares “as likely worthless.”

Shades of the Weimar Republic.

What Reich and the American economic establishment do not understand is that the recession paradigm does not apply. There are no jobs waiting at US manufacturers for a demand stimulus to pull Americans back into work. The problem is not a liquidity problem. To the contrary, there have been many years of too much liquidity. Credit has grown far more than production. Indeed, US production has been moved offshore. Jobs that used to support the growth of American incomes and the tax bases of cities and states have moved, along with US GDP, to China and elsewhere.

The work is gone. All that are left are credit card and mortgage debts.

Anyone who thinks that America still has a vibrant economy needs to log onto www.EconomyInCrisis.org and face the facts.

Economists associate economic depression with price deflation. However, traditionally, debts that are beyond an economy’s ability to service are inflated away. This suggests that the coming depression will be an inflationary depression. Instead of falling prices mitigating the effects of falling employment, higher prices will go hand in hand with rising unemployment--a situation worse than the Great Depression.

The incompetent Clinton and Dubya administrations, unregulated banksters and Wall St criminals, greedy CEOs, and a no-think economics profession have destroyed America’s economy.

What is the remedy for simultaneous inflation and unemployment?

Three decades ago the solution was supply-side economics. Easy monetary policy had pushed up consumer demand, but high tax rates had curtailed output. It was more profitable for firms to allow prices to rise than for them to invest and increase output.

Supply-side economics changed the policy mix. Monetary policy was tightened and marginal tax rates were reduced, thus stimulating output instead of inflation.

Today the problem is different. The US has abused the reserve currency role, thus endangering its credit worthiness and the exchange value of the dollar. Jobs have moved offshore. The budget deficit is huge and growing. If foreigners will not finance the widening gap, the printing presses will be employed or the government will not be able to pay its bills.

The bailout funds have been wasted. The expensive bailout does not address the problem of falling employment and rising mortgage defaults. Treasury Secretary Hank Paulson could not see beyond saving Goldman Sachs and his bankster friends. The Paulson bailout does nothing except take troubled assets off banks’ books and put them on the overburdened taxpayers’ books, thus endangering the US Treasury’s credit rating.

What the Bush Regime has done is to stick the taxpayers with the banks’ mistakes. An intelligent government would have used the money to refinance the troubled mortgages and stop the defaults. By saving the mortgages from default, the banks’ balance sheets would have been made secure. By failing to deal with the subprime crisis, Bush and Congress have added a financial crisis to the exhaustion of consumer demand and the problems of financing huge trade and budget deficits.

Belatedly, Paulson has realized his mistake. On November 12, Paulson announced, “We have continued to examine the relative benefits of purchasing illiquid mortgage-related assets. Our assessment at this time is that this is not the most effective way to use [bailout] funds.”

The financial crisis has cost taxpayers far more than the amount of the bailout. Americans’ savings and pension funds have been devastated. Americans in investment partnerships, who have been required by IRS rules to pay income taxes on gains in the partnerships’ portfolios, have had the accumulated multi-year gains wiped out. They have paid taxes on years of “capital gains” that have disappeared, thus doubling their losses.

America’s economic troubles will rapidly accumulate if the dollar loses its reserve currency role. To protect the dollar and the Treasury’s credit standing, the US needs to curtail its foreign borrowing by reducing its budget deficit. It can do this by halting its gratuitous wars and slashing its unnecessary military spending which exceeds that of the rest of the world combined. The empire has run out of resources, and the 700 overseas bases must be closed.

Can Americans afford massive infrastructure spending when they cannot afford health care? In Florida a Blue Cross Blue Shield group policy for a 60-year old woman costs $14,100 annually, and this is a policy with deductibles and co-payments. Supplementary policies from AARP to fill some of the gaps in Medicare can cost retirees $3,300 annually. When one looks at the economic situation of the vast majority of Americans, it is astonishing that the Bush regime regards wars in the Middle East and taxpayer bailouts of Wall Street criminals as a good use of scarce resources.

US corporations, which have moved their production for US markets offshore in order to drive up their share prices and provide their CEOs with multi-million dollar bonuses, can be provided with a different set of incentives that encourage the corporations to bring employment back to the US. For example, the corporate income tax can be restructured to tax corporations according to the value-added in the US. The higher the value-added in the US, the lower the tax rate; the lower the value-added, the higher the tax rate.

Cutting the budget deficit by halting pointless wars and unnecessary military spending and reducing the trade deficit by bringing jobs back to America are simple tasks compared to confronting inflationary depression.

The world has had enough of American irresponsibility and is taking away the reins. At the November 15 economic summit, the world will begin the process of imposing a new financial order on the US in exchange for continued lending to the bankrupt “superpower.” With bailouts eating up the world’s supply of capital, continued foreign financing for Washington’s wars of aggression is out of the picture.

Source / Information Clearing House

The Rag Blog